According to forecasts from Savills Vietnam, by the end of 2024, the semiconductor industry in Vietnam is expected to surpass a value of USD 6.16 billion, making Vietnam one of the key production centers for many global semiconductor companies.

Vietnam has recently garnered attention for its potential to attract investments in high-tech industries, such as semiconductors, presenting a promising outlook for the industrial real estate market.

Following a series of visits from global tech conglomerate leaders, Vietnam is considered to have significant opportunities in the semiconductor manufacturing sector. Many experts believe that this could be the new driving force that propels Vietnam towards prosperity.

Great Potential Through High-Tech Investment Attraction

According to forecasts from Savills Vietnam, by the end of 2024, the semiconductor industry in Vietnam is expected to surpass a value of USD 6.16 billion, making Vietnam one of the key production centers for many global semiconductor companies.

Several semiconductor firms from the Netherlands have already started to enter the Vietnamese market. Specifically, BE Semiconductor Industries N.V has received an investment certificate in the Ho Chi Minh City High-Tech Park, with an initial investment of over VND 115 billion to lease factories for production.

Recently, Foxconn, the world’s largest electronics contract manufacturer, established an entity to implement a project worth over USD 383 million in the Nam Son-Hap Linh Industrial Park in Bac Ninh Province. This project involves the production, assembly, and processing of printed circuit boards (PCBs), with a total capacity of 2.79 million products per year, covering an area of 14.26 hectares and a total investment of more than VND 9,400 billion (equivalent to USD 383.3 million).

The increasing demand for FDI is expected to continue as Vietnam remains central to the relocation of production chains of global corporations. Besides its strategic location as a gateway for trade in the Asia-Pacific region, Vietnam is also considered a strategic option in the production relocation and supply chain diversification strategy of many high-tech manufacturing corporations.

Enhancing the Quality of Industrial Parks

The anticipated continued inflow of FDI into Vietnam is seen as a catalyst for the ongoing development of Vietnam's industrial real estate. In major industrial hubs such as Binh Duong and Bac Ninh, even industrial real estate in secondary markets like Ba Ria-Vung Tau, Tay Ninh, and Binh Phuoc is expected to maintain growth momentum thanks to infrastructure development. These factors lead experts to expect further improvements in rental rates for this segment.

Additionally, the government's acceleration of key infrastructure projects is a plus for industrial real estate. Meanwhile, the supply of industrial real estate is witnessing significant growth in both the northern and southern regions. However, to attract semiconductor companies, land and warehouses alone are not sufficient. The complexity of this industry requires additional factors that real estate developers need to consider.

Mr. Truong An Duong, Director of Residential Real Estate at Frasers Property Vietnam, stated that in the near future, the demand for various types of production facilities, as well as research and testing centers, and even exhibition and conference centers within industrial parks, will increase. Moreover, emerging industries such as e-commerce, with its data and technology infrastructure requirements, will also demand changes in industrial park planning.

According to Mr. Thomas Rooney, Senior Manager of the Industrial Leasing Department at Savills Vietnam, the demand for semiconductor production and assembly investment will lead to an increase in the search for factories and industrial parks that meet the infrastructure and service requirements of the semiconductor industry. Basic requirements from businesses include a stable power supply, high-speed internet, and efficient water treatment systems, thus placing demands on the quality and system upgrades of factories from investors in Vietnam.

By Vi Anh

The Foreign Investment Agency released data on newly registered, adjusted, and capital contributions or share purchases by foreign investors (FDI) after nine months of 2024.

Friday, 04 Oct, 2024

The investor will officially begin construction of the Deli Hải Dương stationery manufacturing plant, with a total investment of USD 270 million, this weekend on September 28th in Hải Dương. This marks the largest project ever invested in an industrial park in Hải Dương Province to date.

Thursday, 26 Sep, 2024

These industrial infrastructure projects, proposed by both domestic and international investors, are poised to significantly boost the socio-economic development of Thanh Hóa province in the near future.

Wednesday, 21 Aug, 2024

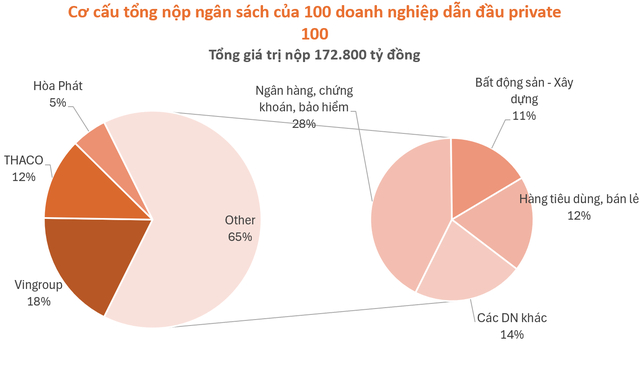

According to the finalized list, the top 100 enterprises in the PRIVATE 100 contributed nearly VND 173 trillion to the state budget in 2023. Among them, more than 30 entities each paid over VND 1 trillion.

Saturday, 17 Aug, 2024

On August 3rd, Taseco Real Estate Investment Corporation, a subsidiary of Taseco Group, held a groundbreaking ceremony for the "Construction and Infrastructure Business of Đồng Văn 3 Support Industrial Park," located east of the Cầu Giẽ - Ninh Bình expressway. The event was attended by Deputy Minister of Construction Nguyễn Tường Văn, Hà Nam's Deputy Secretary Đinh Thị Lụa, Provincial Chairman Trương Quốc Huy, and 500 distinguished guests.

Monday, 05 Aug, 2024

Last week, Hang Dinh - a member of 3C had the incredible opportunity to attend an event hosted by IBM and the CIO Community on the topic of scaling AI in businesses. This event was truly impactful, not just for the practical insights shared but also for the level of engagement and interaction among the speakers and participants.

Monday, 29 Jul, 2024