Increasing investors in industrial parks will make them more competitive and tenant-favorable, with developers offering cheaper rents and other incentives, Knight Frank Vietnam managing director Alex Crane. The senior executive with the global real estate consultants also expects the greening process at industrial parks to intensify as a major factor influencing investor decisions.

What do you see as upcoming industrial real estate trends in Vietnam this year?

Industrial park (IP) occupancy rates in the major economic clusters of greater Hanoi and Ho Chi Minh City (HCMC) stand at a healthy 78% and 92%, respectively, and they will continue to be popular with foreign and local manufacturers.

Vietnam will adopt the Global Minimum Tax in 2024 and this will impact foreign firms looking at expanding in Vietnam because of the large increase on corporate tax and loss of incentives offered for certain industries.

This will add to the cost base of business in Vietnam and we will be more closely aligned with regional markets, making competition to attract new investors a little harder than in the past.

The market for ready-built warehousing and factories has attracted significant foreign investment since 2018, with a fivefold increase in investor numbers. As a result of this surge in supply of space for lease we anticipate the market will continue to be tenant-favourable, with cheaper rents and incentives being offered by developers.

This is now a very competitive marketplace due to the number of investors and developers entering this market. Before 2018, their numbers were scant. The benefit for tenants include greater choice and higher quality properties now being available and this will also help Vietnam remain competitive as there are suitable buildings in all key economic areas that are essentially ready to move into.

While this trend was anticipated, it doesn't inherently pose a risk to the market; it simply keeps costs competitive for occupiers in the near term as the market matures and scales up to compete regionally, particularly against Thailand with its RBW supply 2021 – 2024 CAGR at 6.6% compared to Vietnam's 15% which shows how the sector has grown in the last few years.

Vietnam's commitment to infrastructure spending is among the strongest in the region, and the data center market is poised for transformation, contingent on regulatory challenges being eased and a focus on power infrastructure.

What are the main factors that businesses will consider while selecting the right industrial parks to open their next factories in Vietnam?

Land price and construction costs (or rent if ready-built), access to materials, suppliers or customers, logistics costs and routes to market are all priority factors or criteria. Access to labour is becoming a higher priority, as is industrial park/property management. Vietnam will have to compete with regional neighbours on costs on all these aspects.

We see Thailand as the main competitor currently as land price can now be cheaper than in Vietnam while having similar access to labour and better infrastructure, even though it does not benefit from the Free Trade Agreements that Vietnam has in place.

How is the greening process proceeding at Vietnam’s industrial parks?

Sustainable commercial development will continue. We have seen that office building designs require certification if they are to attract any multinational (MNC) tenants in the future. Remember that many are aiming for Carbon Net Zero by 2023. It is now a prerequisite for western MNCs and will drive the commercial sector. As we have seen over the last few years, I anticipate more sustainable buildings will be required through supply-chains and there will be more environmentally accredited factories and warehouses.

I expect that we will be talking more about not just green buildings, but green leases, which has yet to become a trend here. These focus more on the rights and obligations of the landlords and tenants particularly in relation to efficient operation of the building, its services and energy, etc.

Industrial developers such as Core5, Deep C, Emergent, LOGOS, SLP, YCH, and many other manufacturers like Pandora and LEGO have been early adopters of environmentally conscious design & construction over the last few years and I think this will be adopted in 2024 as the new-normal for future development.

Generally, development of environmentally accredited projects is less expensive than many assumed; and now, with different levels of accreditation it means that there are more achievable goals for projects in the lower pricing bracket. Industrial parks are also a good environment to test more technologies and construction techniques and I would expect to see more renewable power, more efficient waste management and, in the longer term, possibly more use – or reuse – of less impactful materials in building construction.

Source: The Investor

The Foreign Investment Agency released data on newly registered, adjusted, and capital contributions or share purchases by foreign investors (FDI) after nine months of 2024.

Friday, 04 Oct, 2024

The investor will officially begin construction of the Deli Hải Dương stationery manufacturing plant, with a total investment of USD 270 million, this weekend on September 28th in Hải Dương. This marks the largest project ever invested in an industrial park in Hải Dương Province to date.

Thursday, 26 Sep, 2024

These industrial infrastructure projects, proposed by both domestic and international investors, are poised to significantly boost the socio-economic development of Thanh Hóa province in the near future.

Wednesday, 21 Aug, 2024

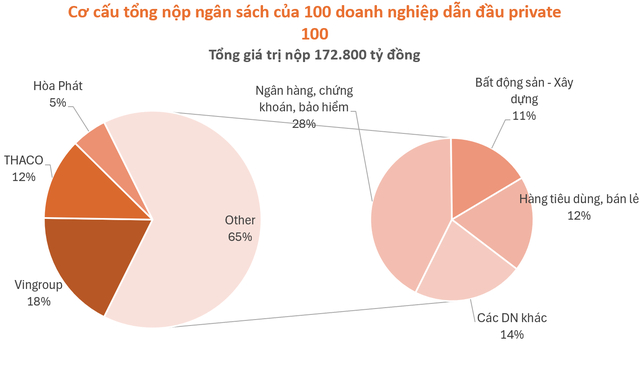

According to the finalized list, the top 100 enterprises in the PRIVATE 100 contributed nearly VND 173 trillion to the state budget in 2023. Among them, more than 30 entities each paid over VND 1 trillion.

Saturday, 17 Aug, 2024

On August 3rd, Taseco Real Estate Investment Corporation, a subsidiary of Taseco Group, held a groundbreaking ceremony for the "Construction and Infrastructure Business of Đồng Văn 3 Support Industrial Park," located east of the Cầu Giẽ - Ninh Bình expressway. The event was attended by Deputy Minister of Construction Nguyễn Tường Văn, Hà Nam's Deputy Secretary Đinh Thị Lụa, Provincial Chairman Trương Quốc Huy, and 500 distinguished guests.

Monday, 05 Aug, 2024

Last week, Hang Dinh - a member of 3C had the incredible opportunity to attend an event hosted by IBM and the CIO Community on the topic of scaling AI in businesses. This event was truly impactful, not just for the practical insights shared but also for the level of engagement and interaction among the speakers and participants.

Monday, 29 Jul, 2024